As the Federal Reserve’s tightening cycle nears its end, the “Magnificent 7” stocks have firmly captured the spotlight for their impressive growth potential. But what about the lesser-known growth stocks that are flying under the radar?

In this article, we will explore three hidden growth stocks that have not received as much media attention but still hold immense potential for investors in 2024.

Join us as we explore these promising yet underrated stocks to watch in 2024, as they could be the hidden gems that outperform the market.

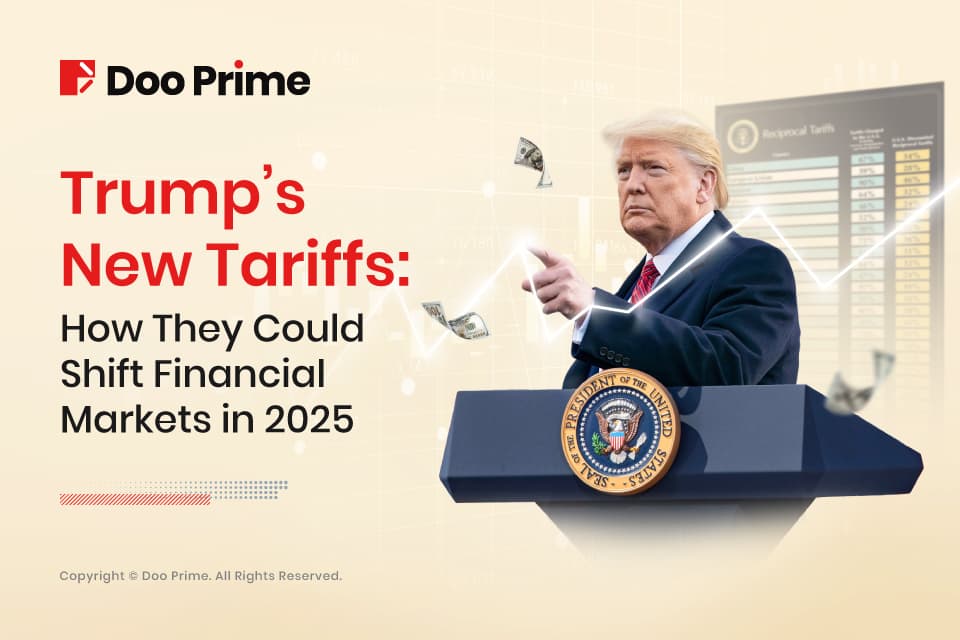

Stocks To Watch In 2024: Uber

Despite the slowdown Uber faced during the pandemic and the 2022 bear market, the global ridesharing and food delivery company bounced back strongly in 2023.

The impressive comeback is because Uber focused on cutting costs, raising prices, and increasing their share of each sale, which led to positive earnings and even becoming profitable in the last two quarters of 2023.

Analysts predict that Uber will continue to grow steadily, and its stock remains a good deal despite having already gone up around 50% since its IPO in 2019. With new services and expansion plans, Uber’s future looks promising.

From a technical perspective, the price is currently attempting to break to new all-time highs. If successful, we could see a massive rally towards 80, 90, or even 100.

Why UBER could be a good buy:

- Recovered from the pandemic with strong growth in bookings.

- Became profitable for the first time in 2023.

- Uber joined the S&P 500 stock index in December 2023.

- Still has room to grow its ride-hailing and food delivery services.

- The stock price is low compared to its future earnings.

- Analysts expect huge profits in the next few years.

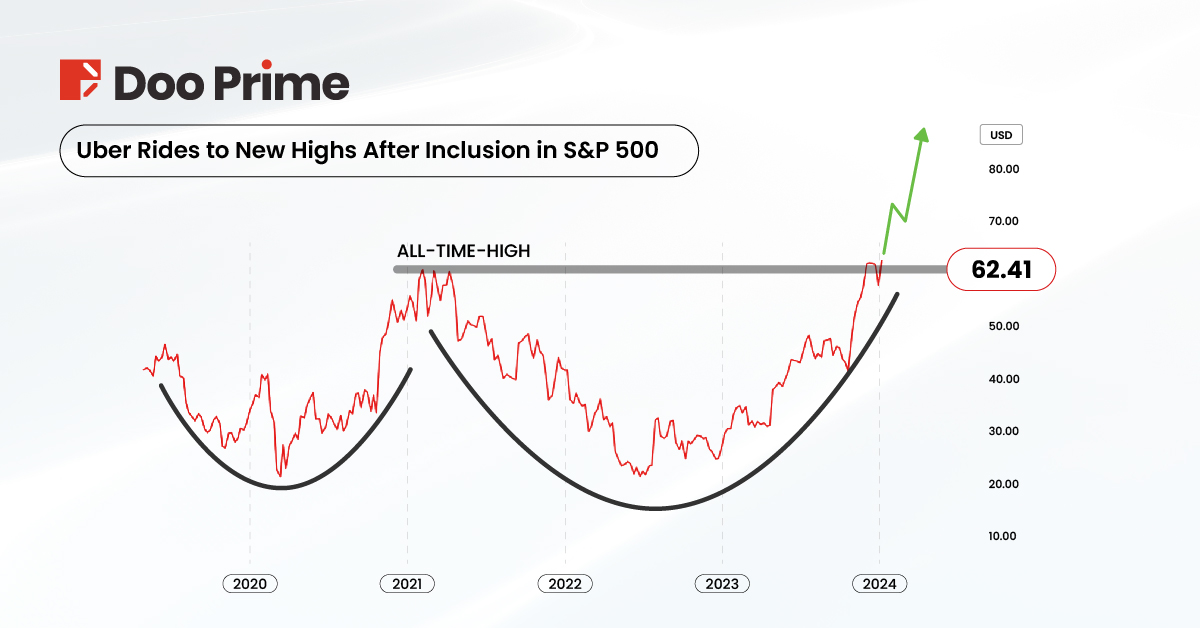

Stocks To Watch In 2024: CrowdStrike Holdings (CRWD)

CrowdStrike stands out in cybersecurity with its cloud-based services, making it cheaper and easier to use.

Despite a 600% stock growth since its 2019 IPO, it has room to grow as more businesses adopt cloud security. With new clients, AI improvements, and a growing number of services, CrowdStrike’s revenue has grown 67% per year from 2020 to 2023, and analysts expect it to keep growing at 30% per year until 2026.

The company is also profitable and is expected to grow its earnings significantly over the next two years. At 66 times its future earnings, CrowdStrike could still be a great investment for those seeking high growth.

From a technical perspective, the price could start to rally much higher once the 300 psychological resistance breaks. The first major target is 350.

Why CRWD could be a good buy:

- Cloud-based security provides easy-to-use protection without the need for heavy hardware.

- The company has experienced rapid growth, with its revenue doubling almost every year since its IPO.

- The future looks bright. Analysts predict continued high growth for several years.

- Profitable for the past few quarters.

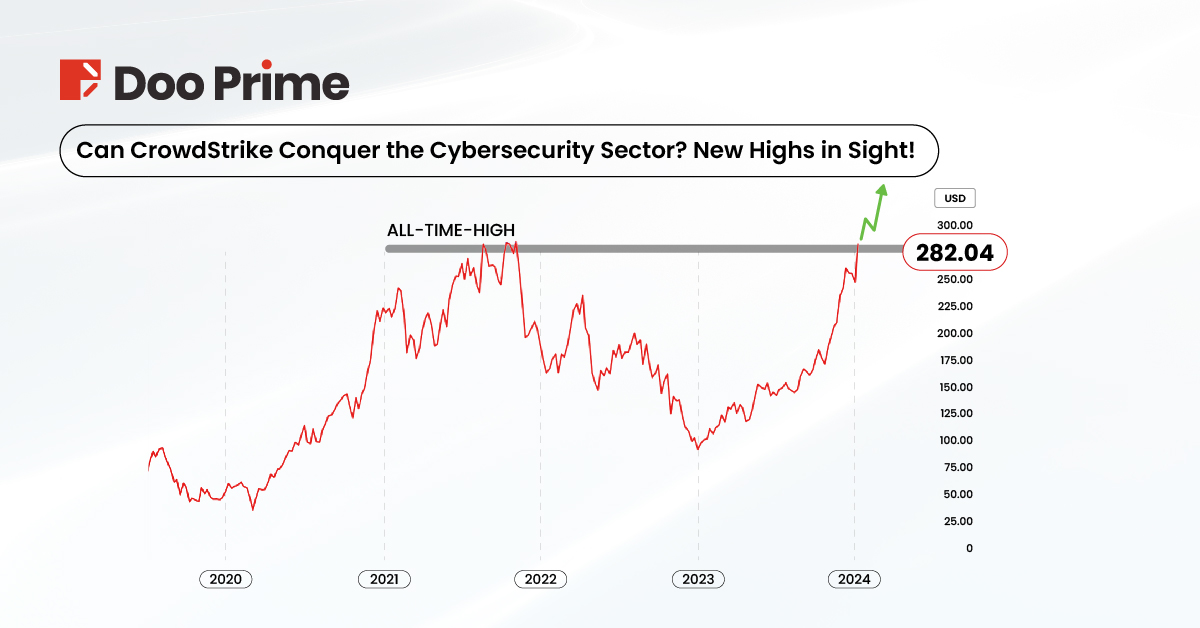

Stocks To Watch In 2024: Visa Inc (V)

Imagine this: You have a bridge that everyone has to cross to buy stuff. Every time someone crosses, you get a small fee.

Visa’s business model is a great example of this, with its payment processing system. Every time a Visa card is used, the company earns a little bit, and it adds up to huge profits.

Visa is extremely profitable, with over half of its revenue turning into net profit. Even though it’s already a big company, it’s still growing. In its latest quarter, its revenue grew 11% to a record high.

From a technical perspective, Visa’s stock is currently trading at new all-time highs. Ideally, a pullback towards 250–240 could be a good buying opportunity for a long-term hold.

Why V could be a good buy:

- Tollbooth business: super simple and profitable. They take a cut from every Visa transaction.

- Profit King: One of the highest profit margins in the whole world. Turns half its revenue into pure profit!

- Still growing: Even though it is huge, it keeps getting bigger. Revenue just hit a record high.

Things to Consider In The Macro

The equity markets could experience a strong rally in the next 3–6 months, recovering from last year’s extremely bearish sentiment. However, considering the macro environment, investors should be mindful of potential geopolitical events and monetary policy decisions that may influence equity markets.

As we discussed in our previous article, there is a possibility of a recession in the second half of 2024. If deflation occurs, it is worth noting that historically, equity markets have experienced significant liquidations during such periods. For a more in-depth analysis, we recommend reading our Fed Signals Rate Cuts analysis.

Looking Towards The Future

With Uber’s impressive recovery, CrowdStrike’s cloud-based security solutions, and Visa’s tollbooth business model, these stocks have the potential to provide great returns for investors in 2024.

While these stocks are very promising, remember, no investment is guaranteed. As always, diversify your portfolio, manage risk wisely, and stay adaptable to market changes.

Even the most promising tides can shift, so flexibility and a well-rounded investment strategy are key to navigating the year ahead.