In a pivotal move, the Bank of Japan’s first interest rate hike in 17 years, signals a significant shift in monetary policy. This decision holds far-reaching implications, particularly for Japan’s stock market, the Nikkei, and the value of the yen.

According to Bank of Japan Governor Kazuo Ueda, this decision comes at a time when a positive economic outlook is emerging, with signs of a beneficial cycle between wage and price increases.

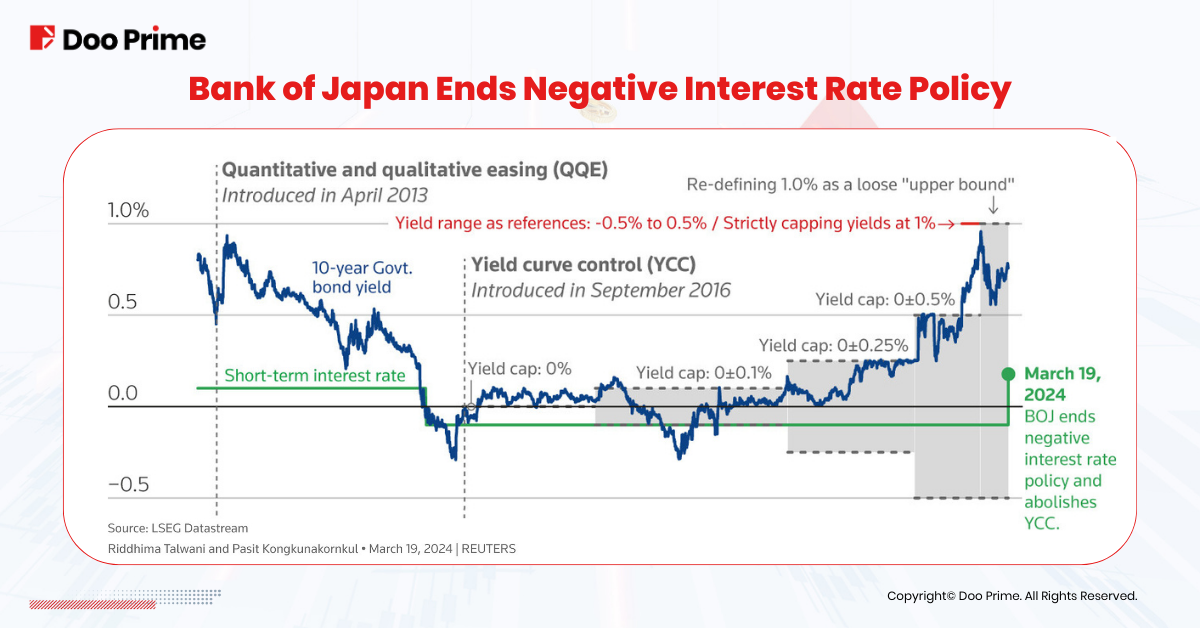

By raising interest rates, the Bank of Japan not only ends the era of negative interest rates and yield curve control policies that have been in place since 2007 but also underscores Japan’s commitment to achieving its 2% inflation target.

This article will delve into the background of Japan’s negative interest rate policy, examine the unusual trends in Japan’s stock and currency markets following the departure from negative interest rates, and offer insights into the potential trajectory post-negative interest rate era.

Understanding the Journey: From Negative to Positive Rates

Japan’s decision to implement and subsequently end negative interest rates stems from its prolonged economic challenges, characterized by sluggish growth, rising unemployment, and deflationary pressures.

To stimulate growth, the Bank of Japan adopted an ultra-loose monetary policy in 2016, slashing its benchmark interest rate to -0.1%.

However, in March of this year, the Bank of Japan announced a 10-basis-point rate hike, bringing interest rates to the range of 0-0.1% and effectively terminating the negative interest rate policy.

Additionally, the bank abandoned the Yield Curve Control (YCC) policy, which aimed to guide long-term government bond yields to around 0%, and reduced purchases of risk assets such as Exchange-Traded Funds (ETFs) and Real Estate Investment Trusts (REITs).

Reasons Behind the Shift: Economic Indicators Speak Volumes

- Gross Domestic Product (GDP)

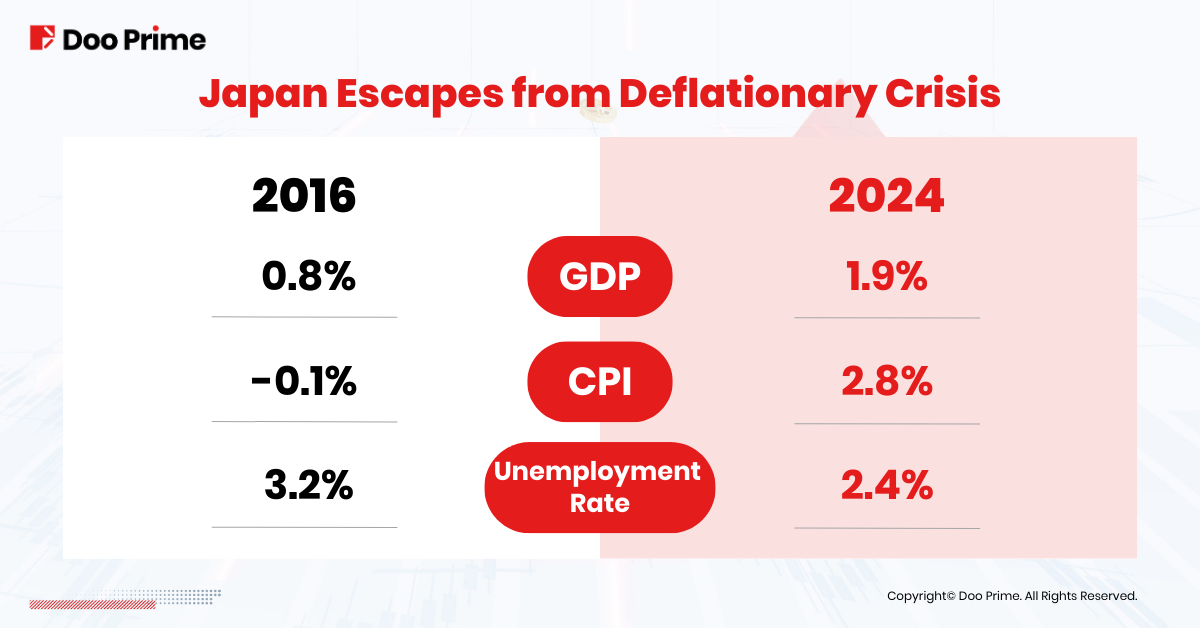

Japan’s real GDP growth increased from 0.8% in 2016 to 1.9% in 2023.

- Consumer Price Index (CPI)

Core CPI, a gauge of inflation, rose from -0.1% in 2016 to 2.8% in February 2024, surpassing the 2% inflation target for 23 consecutive months.

- Unemployment Rate and Spring Wage Negotiations

The unemployment rate dropped from 3.2% in 2016 to 2.4% in January 2024. The significant increase in average wages during the spring wage negotiations or shunto of 2024, reaching 5.28%, indicated a positive shift in wage dynamics.

Bank of Japan Governor Kazuo Ueda had previously hinted at the possibility of policy changes, including ending negative interest rates, if a benign cycle between wages and inflation was confirmed. As Japan’s economy gained momentum, with inflation transitioning from supply-driven to demand-driven, the Bank of Japan opted for its first interest rate hike in 17 years.

Bank of Japan’s Rate Hike Impact: Yen Depreciation and Nikkei’s Resilience

The Bank of Japan’s decision to tighten monetary policy has triggered global financial market volatility, particularly in Japan’s stock and currency markets.

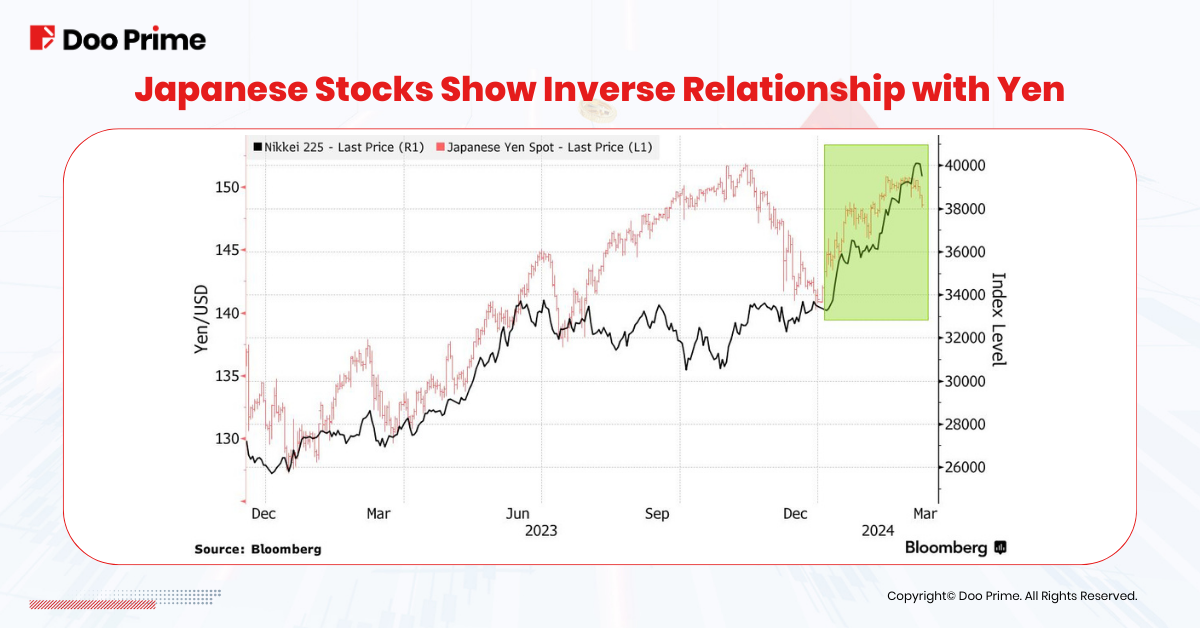

Typically, tightening monetary policy suppresses stock markets and strengthens national currencies. However, two anomalies were observed following Japan’s rate hike:

- Nikkei Index Sustains Record Highs

Despite expectations of a downturn, the Nikkei 225 index continued its upward trajectory throughout 2024, surpassing the significant milestone of 40,000 points in March.

Remarkably, even after the Bank of Japan’s departure from negative interest rate policy, the stock market remained resilient, maintaining its position above the 40,000-point mark.

- Yen’s Long-standing Weakness Reversed

In an unexpected turn, the Japanese yen depreciated rather than appreciated following the Bank of Japan’s interest rate hike announcement.

On the day of the announcement, the yen fell against the US dollar, breaching the crucial threshold of 150 yen per dollar and lingering near multi-decade lows.

Subsequently, the dollar surged against the yen, reaching a four-month high of 151.86, approaching its 32-year peak of 152 yen.

The inverse correlation between the Nikkei index and the yen suggests that a strong stock market is often accompanied by yen depreciation.

Despite the termination of negative interest rates and YCC policies, the Bank of Japan has indicated a temporary continuation of accommodative monetary policy.

However, verbal interventions by the Japanese Ministry of Finance to support the yen may limit its depreciation, thereby restricting the upside potential of Japanese stocks.

Prospects Beyond the Negative Interest Rate Era: Economic Resurgence or Recession?

The Bank of Japan’s latest monetary policy marks the end of the global era of negative interest rates, potentially ushering in a period of high-interest rates and inflation.

As Japan embarks on this new phase, questions arise about the future trajectory of its economy. Will Japan experience a period of economic prosperity, or is it on the brink of another recession?

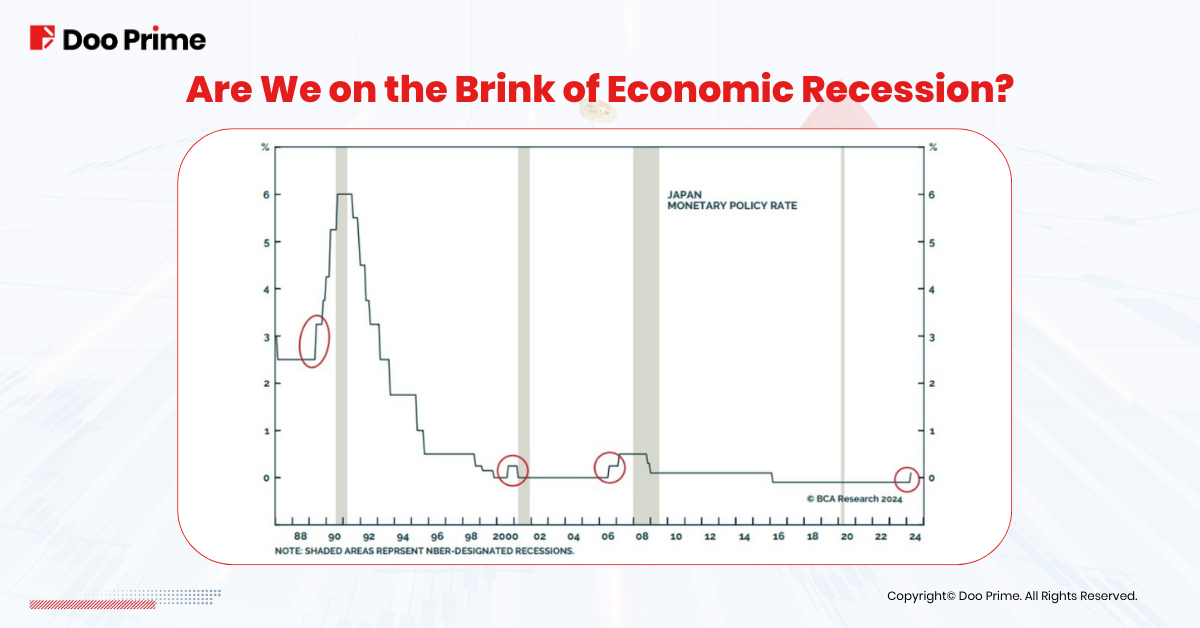

Given historical patterns, previous interest rate hikes by the Bank of Japan have often been followed by economic downturns. Therefore, despite the optimism surrounding Japan’s economic recovery, uncertainties loom regarding its future economic prospects.

In conclusion, the Bank of Japan’s decision to raise interest rates for the first time in 17 years has far-reaching implications for Japan’s economy, financial markets, and the global economic landscape.

As Japan navigates through this transition, stakeholders will closely monitor economic indicators to gauge the trajectory of its recovery.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and the client should therefore be prepared to suffer significant losses when using such trading facilities.

Please ensure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to learn more.