Over the past week, Bitcoin, and the cryptocurrency market in general, have undergone turbulent times. Trading volume, active wallets, and reports of capital outflows paint a grim picture. Amidst these swirling currents, a pressing question emerges: Are we on the brink of another crypto winter?

In this article, we will address this concern by comprehensively analyzing the factors that have pressured Bitcoin’s price, historical data, and future signals to determine Bitcoin’s next direction.

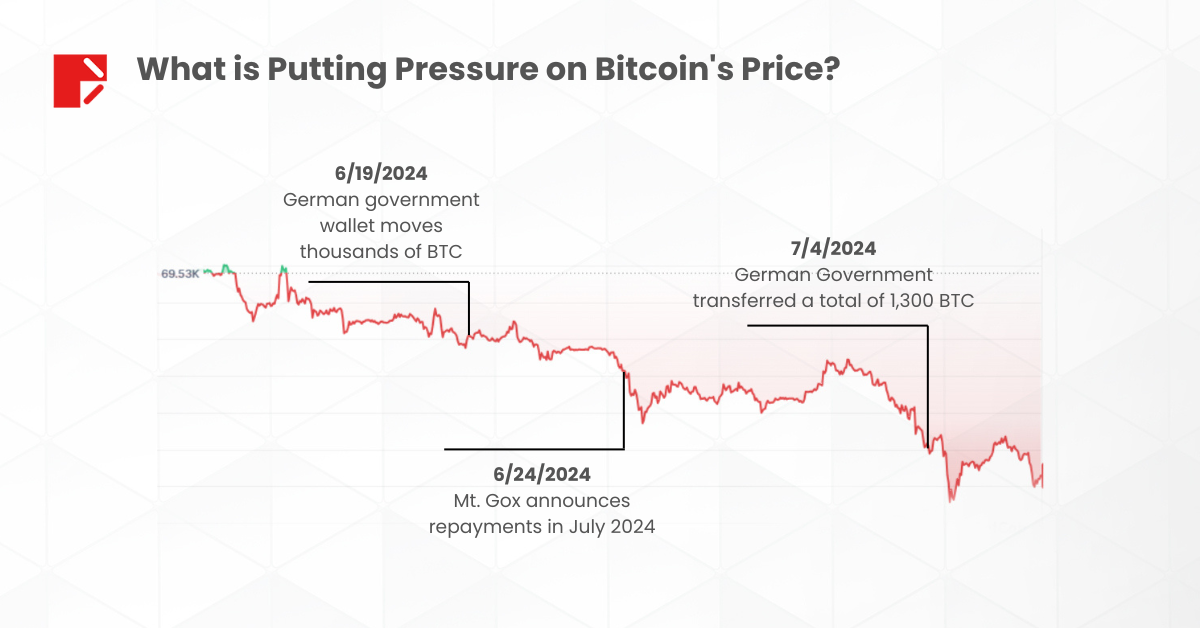

What is Putting Pressure on Bitcoin’s Price?

Events Impacting Bitcoin’s Price

Given its nature as a highly volatile market, Bitcoin is currently in an unstable phase with negative external pressures from relevant individuals and organizations.

Delayed Fallout from Mt. Gox’s Bankruptcy

Once one of the largest Bitcoin exchanges, Mt. Gox’s catastrophic demise following a massive hack has left a lingering shadow. Recent developments saw plans unveiled to distribute $9 billion worth of Bitcoin by July. According to Arkham Intelligence, a wallet associated with Mt. Gox moved Bitcoins worth $2.7 billion on 05/07.

With such a large supply suddenly hitting the market, two scenarios could unfold. One is that with better liquidity, the market could recover. The other is that investors, who have been panicking for a long time, might try to pull out their funds to invest in safer assets.

Overall, with the uncertainty about market developments after Mt. Gox redistributes $9 billion in Bitcoin, the market could see violent fluctuations.

German Government’s Cryptocurrency Sell-off

According to Arkham, the German government transferred a total of 1,300 BTC to Bitstamp, Coinbase, and Kraken, worth about $75.53 million, marking the largest recent transfer to CEXs. This move has also added pressure on Bitcoin’s price.

“One of the top reasons for the drop in Bitcoin prices is Germany’s sell-off, stimulating a sell-off mentality in the market,” said Lucy Hu, a senior analyst at Metalpha.

Downtrend Phase: Toward a Crypto Winter?

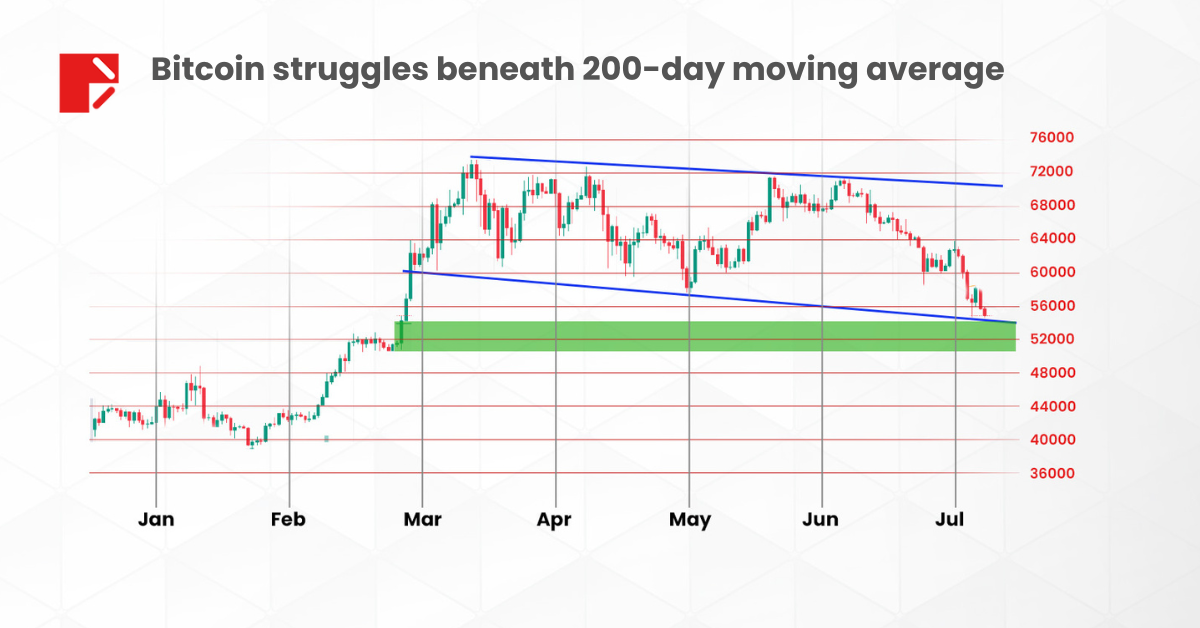

The current pricing model starkly illustrates a downward trajectory. As of July 8, 2024, Bitcoin struggles beneath the oppressive weight of the 200-day moving average (SMA200), floundering amidst relatively low trading volumes. A critical support level hovers around the $50,000 mark, a thin line between recovery and further descent.

The Historical Cycles of Crypto Winter

The cryptocurrency market has gone through several “winters,” a term used to describe a period when the market experiences deep and prolonged price declines, causing disappointment among many investors. This phenomenon has occurred three times in history:

- Late 2013 – Early 2015: Bitcoin first peaked at $1,200, then dropped below $200 by early 2015.

- Early 2018 – Late 2019: Fell to the $4,000 mark from a peak of $20,000 due to overheating.

- Mid-2022 – Early 2023: From a high of $69,000, it tumbled to around $20,000.

With Bitcoin’s price continuously dropping to the lowest levels since early May, the question arises:

Will There be a “Crypto Winter” in 2024?

In seeking answers, we must consider the broader macroeconomic influences currently at play and juxtapose them with those from recent downturns. The most recent ‘winter’ offers insights into what may lie ahead:

Mid-2022 – Early 2023 Crypto Winter

- Central banks raising interest rates: In 2022, the Fed began raising interest rates. Higher interest rates strengthen the currency value. Therefore, the attractiveness of risk assets, including cryptocurrencies, is diminished. Investors in this period usually turn to safe-haven assets.

- Collapse of cryptocurrency funds and projects: Terra/LUNA and FTX, one of the largest cryptocurrency exchanges, collapsed. This led to a loss of confidence in the market, causing outflows to skyrocket.

- Global economic instability: Macroeconomic factors such as the Russia-Ukraine war and concerns about a global economic recession have created uncertainty in the financial markets.

- Liquidity shortage: As money rapidly and extensively flowed out of the market, the cryptocurrency market, which already had limited liquidity, faced compounded pressure.

Bitcoin’s Hope Amidst Gloom

Despite these daunting challenges, not all is lost. The market dynamics of 2024 bear positive tidings that could shield the crypto realm from enduring another icy season:

- Fed’s Interest Rate Cuts: With positive inflation indices and a stable labour market, anticipated rate reductions could reignite interest in riskier assets like Bitcoin.

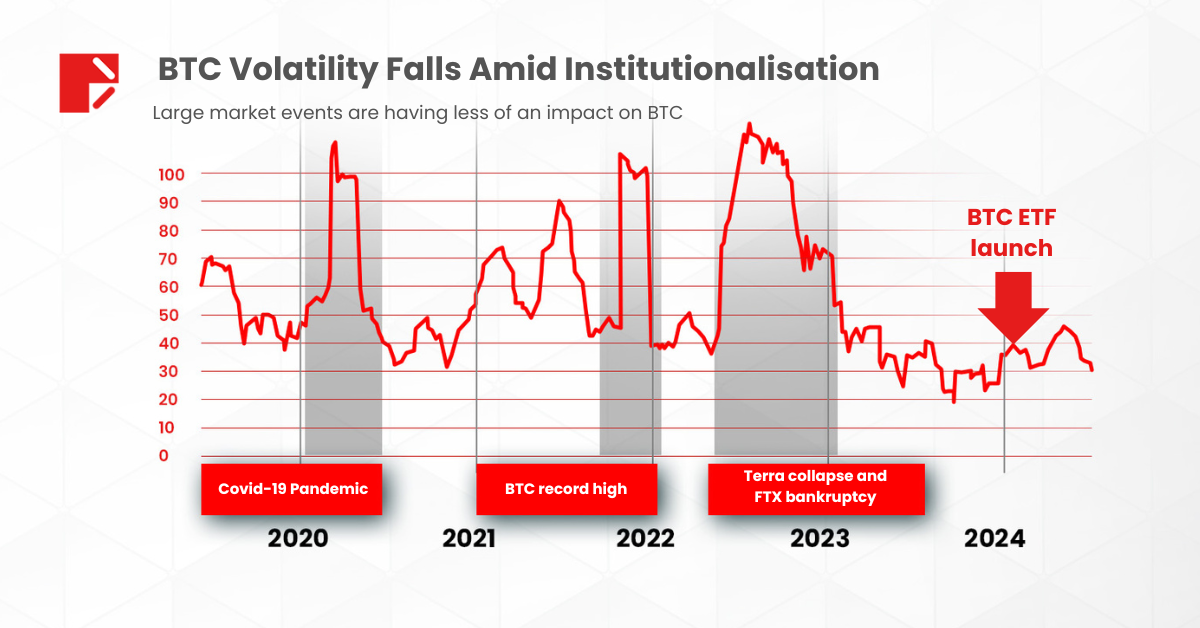

- Launch of Bitcoin ETFs: The launch of Bitcoin Exchange-Traded Funds (ETFs) marked a significant step forward in the cryptocurrency sector, expanding access and legitimizing Bitcoin among traditional investors. After their introduction, US Bitcoin spot ETFs had a trading volume of $200 billion.

- RRP (Reverse Repo) ensures good liquidity: By securing liquidity and controlling short-term interest rates, RRP can create a more stable economic environment beneficial for various investments, including cryptocurrencies.

Additionally, an important factor and the trend of adoption and application of digital assets by businesses, institutions. According to SBIDAH’s May report on Institutional Adoption of Digital Assets, 42% of businesses are prioritizing Cryptocurrencies as their preferred asset type.

Moreover, since the beginning of 2023, the average 60-day volatility of Bitcoin has remained below 50%, despite the significant impact of the ETFs launch. This is evidence that a market is maturing and gaining more trust day by day.

What Can Investors Do?

With the market showing both negative and positive signals, from our perspective, we should focus on factors that have long-term impacts.

In this aspect, with more and more signs that the cryptocurrency market in general and Bitcoin in particular are maturing in terms of legal and asset structure, Bitcoin seems unlikely to undergo a “winter” as before. Instead, market fluctuations and the impacts of supply-demand factors are merely “tests” for the market.

Technically, the resistance level at the $50,000 mark is considered crucial. If the price tests this area several times, the Fed’s interest rate is likely to be the catalyst that causes the price to recover. At the same time, it is important to closely monitor price fluctuations when a large amount of Bitcoin from Mt. Gox enters the market. As always, be cautious before any fluctuations and cleverly seize appropriate opportunities from macro news during this period.

Read more our weekly market dive article for more helpful insights.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.