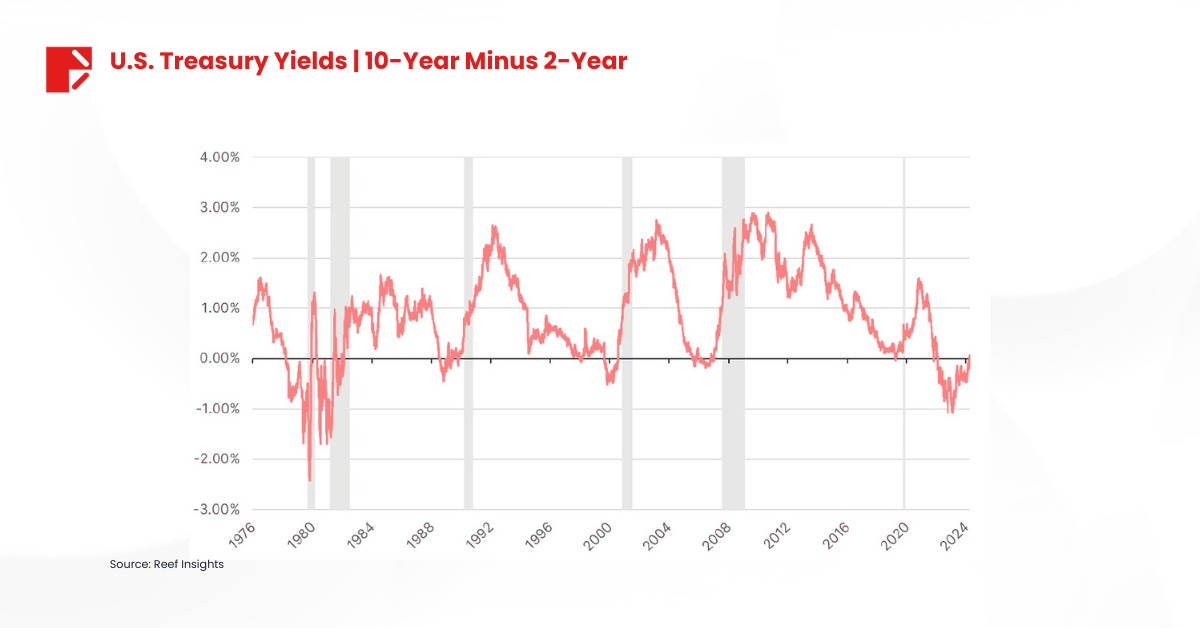

Are we just months away from a recession? According to the inverted yield curve, it’s highly possible!

Historically, when the inverted yield curve turns positive, it often signals that the countdown to a recession has begun.

Since 1980, the inverted yield curve has turned positive six times. In all six instances, the economy slid into recession, with the stock market following suit.

But before you rush to sell your stocks or short the market, read on to understand the impact of the positive yield curve on equities, the USD, and gold—plus when and why investors should proceed with caution.

What is the Inverted Yield Curve?

An inverted yield curve occurs when short-term Treasury yields rise above long-term yields, which is the opposite of the usual pattern. In this case, it refers to the yield on the 2-year Treasury exceeding that of the 10-year Treasury. This inversion suggests that investors expect weaker economic growth or even a recession in the long term, which could lead to lower interest rates down the road.

For nearly two years, we’ve seen this inversion, reflecting concerns about the economy’s future. However, the yield curve has recently turned positive again, indicating a shift—but not necessarily signaling that economic risks have disappeared.

Yield Curve Turns Positive: Historical Pattern

Every time the yield curve has turned positive after being inverted—6 out of 6 times since 1980—the U.S. economy has entered a recession. This pattern has been remarkably consistent, serving as one of the most reliable indicators for economic downturns.

We are now witnessing the 7th occurrence of this shift, raising the critical question: Will this time be different?

Historically, when the yield curve turns positive, there’s typically a lag of 5 to 6 months before the full effects hit the economy. This lag period gives investors a brief window before the downturn begins to unfold. The signal often indicates that the initial concerns about the economy have persisted or even worsened.

Moreover, other factors—like the current high levels of debt, increase in unemployment rates, inflationary pressures, and global instability—could mean that the economy is under even greater strain than in previous cycles.

Are we set for another recession, or will policymakers and market forces intervene in time to change the narrative? The answer remains uncertain, but past data suggests caution.

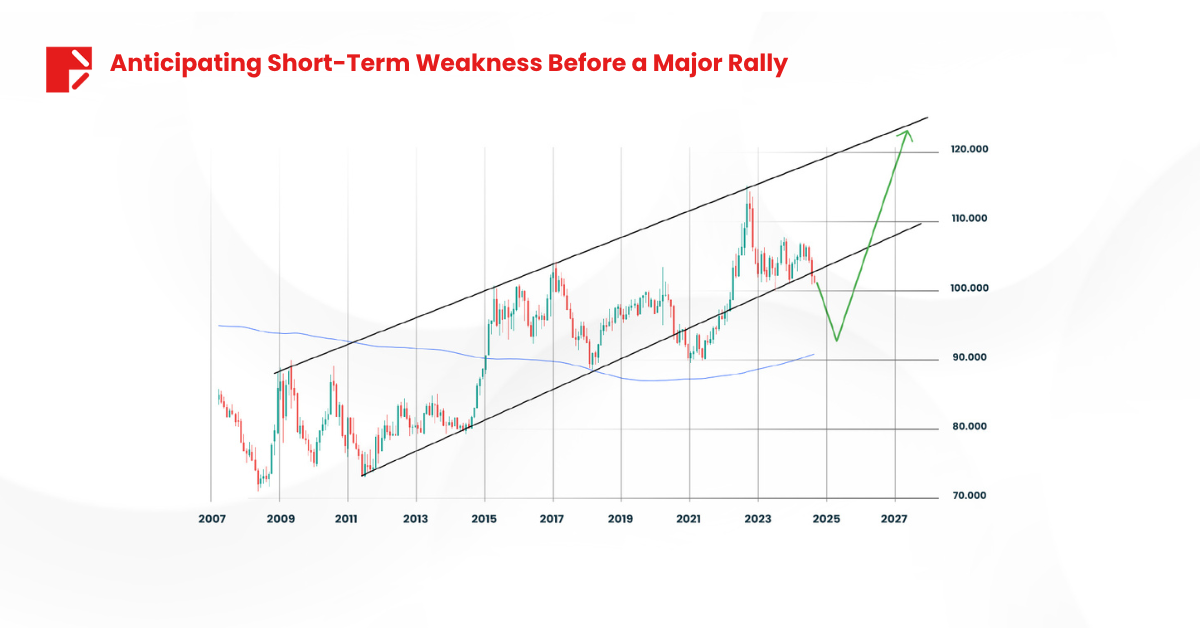

Yield Curve Turns Positive: What It Means for the USD

As the Fed begins to cut interest rates, we could see further short-term weakness in the U.S. dollar.

Historically, during the early stages of the yield curve turning positive, the USD tends to decline because of lower yields making it less attractive for investors.

However, if a recession officially takes hold, the USD often regains strength, as investors seek safety in the world’s reserve currency.

In the near term, we may see the Dollar Index (DXY) dip toward the low 90s, but once recessionary fears fully materialize, the greenback could stage a strong reversal, potentially climbing back towards 110 and beyond.

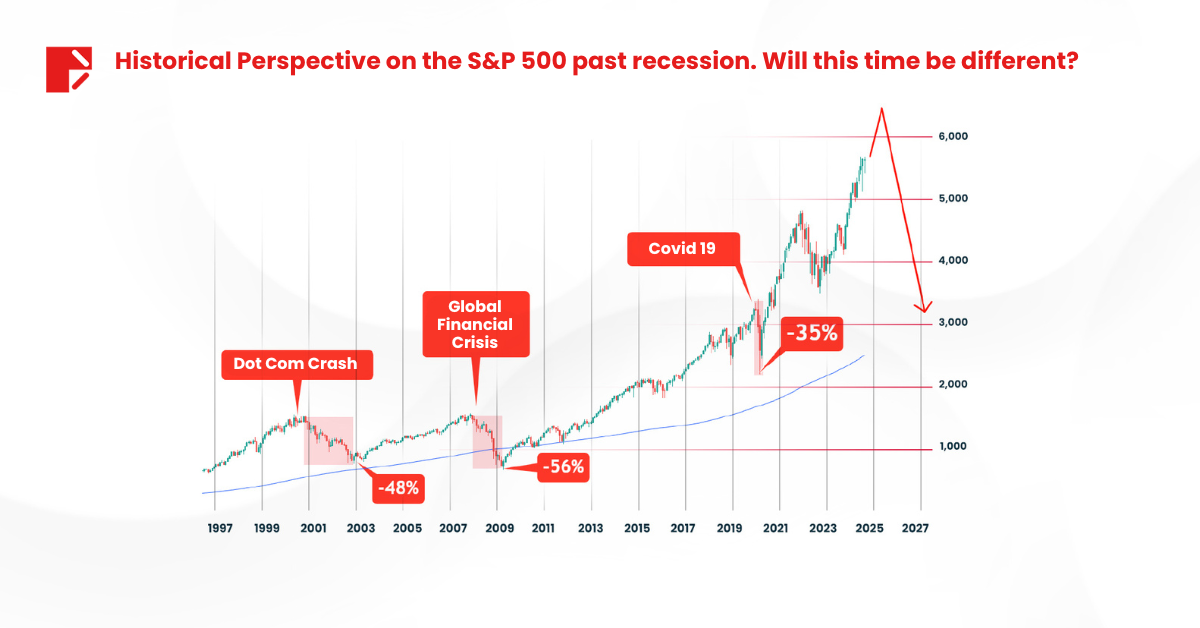

Yield Curve Turns Positive: Impact on the Stock Market

In the short term, the stock market could experience a continued rally, with the S&P 500 potentially pushing toward 6,000 or beyond as optimism grows.

However, history suggests that this initial surge is often temporary. Once a recession officially takes hold, investors should brace for a significant market downturn.

In previous cycles, recessions following a positive yield curve have led to significant market crashes, with stocks declining by 35% in 2020, 56% in 2008, and 48% in 2000.

Investors should remain cautious, as the transition from short-term gains to a severe correction can happen in the blink of an eye.

Yield Curve Turns Positive: Gold’s Role as a Safe Haven

In the short term, gold prices could climb toward $3,000 as the Fed continues to cut rates, boosting demand for the precious metal.

However, once a recession hits, we may see a sharp pullback in gold prices. During severe economic downturns, liquidity becomes paramount, and investors often liquidate all assets, including gold, to raise cash or flee to the USD, which remains the world’s primary reserve currency. This flight to safety typically occurs while waiting for the Fed’s next monetary policy decision.

The Calm Before the Storm?

As the yield curve turns positive and recession signals flash brighter, investors are at a crucial decision point. While history tells us that a recession is likely to follow, the timing and severity remain uncertain.

In the short term, we may see continued strength in the stock market, weakness in the USD, and a rally in gold, but these movements could quickly reverse once recessionary pressures take hold.

The key for investors is to remain vigilant and prepare for all scenarios.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.