“We are the world’s engine of AI,” proclaimed Jensen Huang, the visionary founder and CEO of NVIDIA, when describing this chip giant that recently achieved a remarkable milestone by surpassing a USD 1 trillion market cap.

In 2023, AI has emerged as a red-hot trend, and NVIDIA, as a leading provider of core AI technologies, has emerged as the ultimate victor. Since the beginning of the year, NVIDIA’s stock price has skyrocketed by over 200%, propelling its market cap beyond USD 1 trillion on May 30th.

This phenomenal achievement not only exceeds the combined market value of its competitors AMD, Intel, and Micron but also propels NVIDIA into the illustrious “trillion-dollar club,” alongside Meta, Amazon, Microsoft, Google, Apple, and Tesla.

While NVIDIA appears unstoppable in its trajectory, critics are also raising concerns about its future prospects. In this article, we will dissect NVIDIA’s unique advantages and potential risks, helping you to assess its future prospects and seize valuable investment opportunities.

Distinctive Advantages Empower New Heights

NVIDIA’s dominant position in the AI chip sector is well-founded. Over the years, NVIDIA’s cultivation of dedicated graphics cards has now found a prime opportunity in the AI field, and its distinctive technologies further fortify its stronghold in the chip market.

Additionally, NVIDIA has always been at the forefront of development, strategically positioning itself in the emerging market of generative AI by acquiring several start-up companies, thereby strengthening its comprehensive edge AI strategy.

- Riding the AI Wave

AI is currently at the forefront of technological advancements, and the training of large language models heavily relies on the high computational power of independent graphics cards. NVIDIA proudly stands as the first chip company to successfully develop dedicated graphics cards. Its A100 and H100 chips, serving as the bedrock of AI development, are now in high demand with skyrocketing prices.

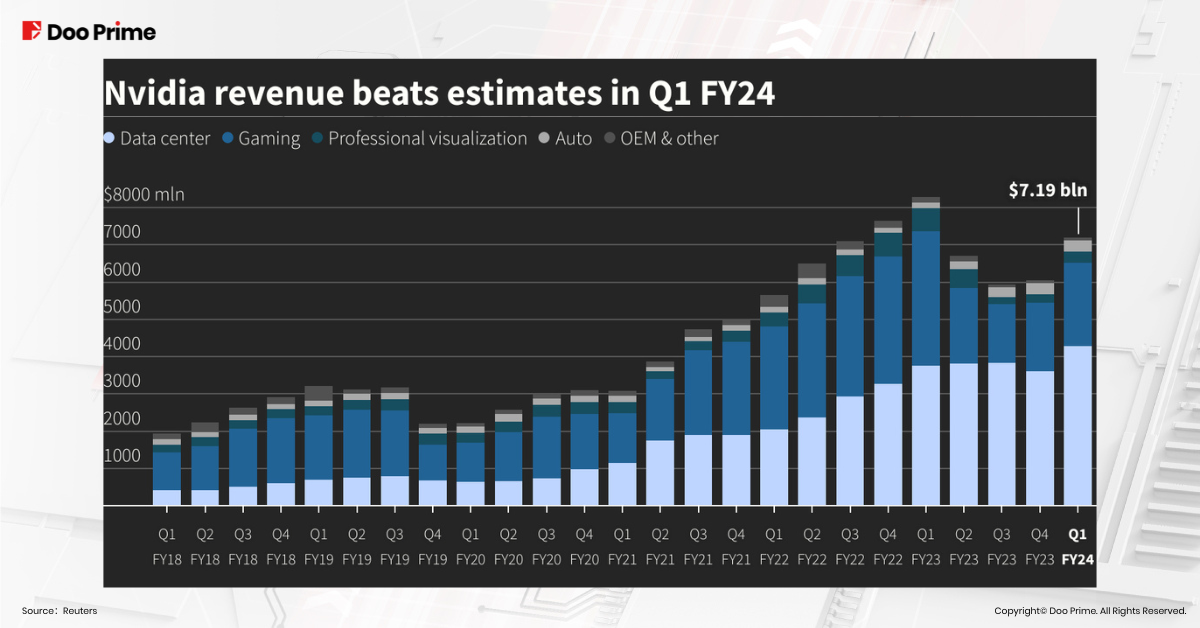

In NVIDIA’s Q1 FY2024 financial report, its revenue and net profit exceeded market expectations. Notably, within its four major business segments—data centers, gaming, professional visualization, and automotive—the data center business has shown consistent revenue growth.

In the latest quarter, data center revenue reached a record USD 4.28 billion, an 18% increase from the previous quarter and a 14% increase from the same period last year. This demonstrates NVIDIA’s increasingly important contributions to AI development, and Citigroup analysts even predict that NVIDIA will hold at least a 90% market share in the AI chip market.

In addition to Citigroup’s reaffirmation of its “buy” rating with a target price increase from USD 520 to USD 600, Morgan Stanley analysts also express recognition of NVIDIA’s robust performance driven by the AI trend. They maintain an “overweight” rating on NVIDIA stock, setting a year-end target price of USD 500.

Furthermore, renowned investment bank Goldman Sachs recently raised NVIDIA’s 12-month target price from USD 440 to USD 495, while upholding a “buy” rating. These examples clearly demonstrate the financial market’s confidence in NVIDIA’s future, with the expectation that the AI frenzy will continue to drive NVIDIA’s stock price upwards in the short term.

- A Challenge to Replicate Unparalleled Chip Technology

In the fast-paced world of chip industry development, the landscape is characterized by rapid advancements and intricate research and production techniques that are notoriously difficult to reproduce. The competition barrier in this domain is exceptionally high.

Enter NVIDIA, an industry pioneer that has long been synonymous with cutting-edge independent graphics cards. Back in 1999, NVIDIA revolutionized the market with its groundbreaking GeForce256 graphics card, leaving competitors trailing in its wake.

Jensen Huang, the visionary behind NVIDIA, introduced “Huang’s Law,” predicting that GPUs would drive a year-by-year doubling of AI performance. Over the years, NVIDIA has spared no effort, dedicating significant manpower and resources to create star products like the A100 and H100 that ride the crest of the AI wave.

Today, the A100 graphics card has become the gold standard for training large-scale models, and the global sensation ChatGPT owes its existence to the training prowess of tens of thousands of A100 graphics cards.

Not resting on its laurels, NVIDIA unveiled the upgraded H100 in 2022, boasting a performance four to six times that of its predecessor. NVIDIA’s continuous self-breakthroughs have solidified its position as an industry leader.

- Venturing into Generative AI

NVIDIA has embarked on a strategic journey, investing in several innovative startups focused on generative AI. Among them are Inflection AI, RunwayML, Cohere, and OmniML.

Inflection AI, considered a top contender to OpenAI, has crafted chatbots akin to the renowned ChatGPT. Runway, an AI video software company, is fervently pioneering the uncharted realm of “synthetic media.”

Cohere, a generative AI startup, caters to enterprise needs, providing valuable support for copywriting, search, and summarization tasks. OmniML, on the other hand, has honed its expertise in shrinking machine learning (ML) models, enabling the seamless integration of large-scale models into edge devices such as drones, smart cameras, and automobiles.

NVIDIA’s strategic moves in these domains further fortify its comprehensive edge AI strategy, reinforcing its position as the vanguard of the AI market.

Potential Risks, Rivals, And Market Challenges In the Horizon

Despite NVIDIA’s impressive achievements and trillion-dollar market cap, skeptics are growing in number. The significant surge in NVIDIA’s stock price has led to speculation of overvaluation, and other tech giants and chip manufacturers are developing their own products to compete in the market. It remains uncertain whether NVIDIA can maintain its momentum and continue to rise.

- Stock Price Overvaluation

As of the time of writing, NVIDIA’s stock price has surged by a remarkable 207.72% since the beginning of the year, reaching an impressive USD 457.87. However, its price-to-sales ratio exceeds that of Meta, Amazon, Google, Apple, Microsoft, Netflix, and Tesla by a considerable margin. A higher price-to-sales ratio indicates a lower investment value for the company’s stock.

Consequently, Cathie Wood, the founder of Ark Invest, liquidated her holdings in NVIDIA earlier this year. Similarly, Aswath Damodaran, a respected Professor of Finance at the Stern School of Business at New York University known as the “valuation guru,” significantly reduced his long-held position in NVIDIA.

Not only are investors starting to sell, but even members within NVIDIA are cashing out. NVIDIA’s CFO and Executive Vice President, Colette Kress, as well as board members Tench Coxe, Harvey Jones, and Mark Stevens, have all been selling their NVIDIA shares. In June alone, these three directors cashed out approximately USD 186 million.

The market’s widespread selling of NVIDIA at its peak and the realization of profits suggest that its stock price may indeed be overvalued.

- Tech Giants Developing In-House Chips

While NVIDIA currently dominates the production of AI chips, no industry player wishes to be solely reliant on a single supplier. In recent times, Google, Apple, Microsoft, Amazon, and Meta have all invested in developing their own AI chips to reduce dependence on NVIDIA.

Google has unveiled the TPU v4 (Tensor Processing Unit), boasting performance surpassing NVIDIA’s A100 chip. Apple utilizes its A-series and M-series chips in its iconic products to accelerate machine learning and neural network processing capabilities.

Microsoft has even collaborated with AMD, a direct competitor to NVIDIA, to develop the Athena AI chip. Tesla’s AI team is also poised to launch Dojo, a supercomputer designed for machine learning, featuring Tesla’s own custom-designed chip.

NVIDIA’s chip supply shortage and the potential for price hikes could directly impact the deployment plans of these cash-rich and talent-rich industry leaders. As a result, these industry titans are aggressively developing their own AI chips, with the possibility of entirely replacing NVIDIA in the future.

- Benchmark Products Launched by Competitors

In addition to the threat posed by tech giants, NVIDIA is facing fierce competition within its industry.

AMD has introduced the Instinct MI300 “accelerator processor” as a direct rival to NVIDIA’s flagship product, the H100. According to technical specifications released by AMD, the MI300’s computational speed has already surpassed that of NVIDIA.

Intel has launched Gaudi 2 to penetrate the generative AI market. Regarding the performance of this accelerator card, Intel claims that Gaudi 2 outperforms NVIDIA’s A100 in various training and inference benchmark tests, although it falls short of the H100’s performance. However, it possesses a significant cost advantage.

Furthermore, start-up company Graphcore claims to have more efficient and cost-effective Intelligence Processing Units (IPUs). The Graphcore C600 IPU provides powerful computing capabilities while achieving low latency and low power consumption, addressing the pain points of AI developers struggling with the trade-off between precision and speed.

While these benchmark products from competitors have yet to match NVIDIA, they have the potential to shake NVIDIA’s position as the industry leader. For NVIDIA’s GPUs, which are grappling with supply-demand imbalances, chips like the AMD MI300X and Intel Gaudi 2 could emerge as formidable alternatives.

Navigating Bullish And Bearish Factors, Seizing The Right Time To Enter

If investors have missed out on NVIDIA’s astounding 200% surge this year, should they continue buying at its peak?

NVIDIA’s core business of independent graphics cards, fueled by the AI wave, has nearly monopolized the AI chip market. Its relentless breakthroughs in chip technology make it difficult for competitors to surpass.

Furthermore, NVIDIA remains forward-thinking, acquiring multiple startups in line with major trends in generative AI. These advantages bode well for NVIDIA’s short-term trajectory, ensuring a continued robust upward movement.

However, many argue that NVIDIA’s surging stock price is actually overvalued. Coupled with the relentless push from tech giants and chip industry rivals unveiling alternative products, NVIDIA’s industry-leading position may be at risk.

These bearish factors could lead to significant fluctuations in NVIDIA’s stock price, and investors should be cautious when considering the entry timing.

NVIDIA’s second-quarter financial report is scheduled for release on August 23rd. NVIDIA has forecasted revenue of USD 11 billion for the second quarter, surpassing market expectations by 50% compared to the projected USD 7.18 billion. Investors can leverage this financial report to evaluate NVIDIA’s recent performance and make predictions about its future trajectory.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.