Doo Prime Partners With Trading Central and Brings You Analyst Views, Economic Calendar and Forex Featured Idea

(HONG KONG, March 3) – Doo Prime has announced a collaboration with Trading Central, known as the global leader of the financial technology innovation, as well as a premium, one-stop shop for investment decision support.

Basically, Trading Central is a fin-tech company that provides transaction analysis related to derivatives services and it has cooperated with many of our peers alongside some large platforms.

Trading Central’s main ethos will support Doo Prime’s brokerage business by facilitating the long-lasting success of Doo Prime’s investing customers.

To achieve that, Trading Central will assist in finding and validating new opportunities for investors, time investor’s trades, learn about financial markets, and manage investor’s risk. Also, Trading Central’s solution harness an award-winning fusion of automated AI analytics, impressive user interfaces and registered investment adviser expertise.

The products that we are collaborating on are the Analyst Views, Economic Calendar and Forex Featured Idea.

Analyst Views

Trading Central, Analyst Views Interface

The Analyst Views drives confident decisions with simple, and actionable trading plans for investors as it will help investors understand the technical scenario at a glance. All analyses are identified using the proprietary top-down global-macro model created by Trading Central’s award-winning research team. Additionally, the Analyst Views is constantly scanning the market to provide full position management on over 8,000 instruments.

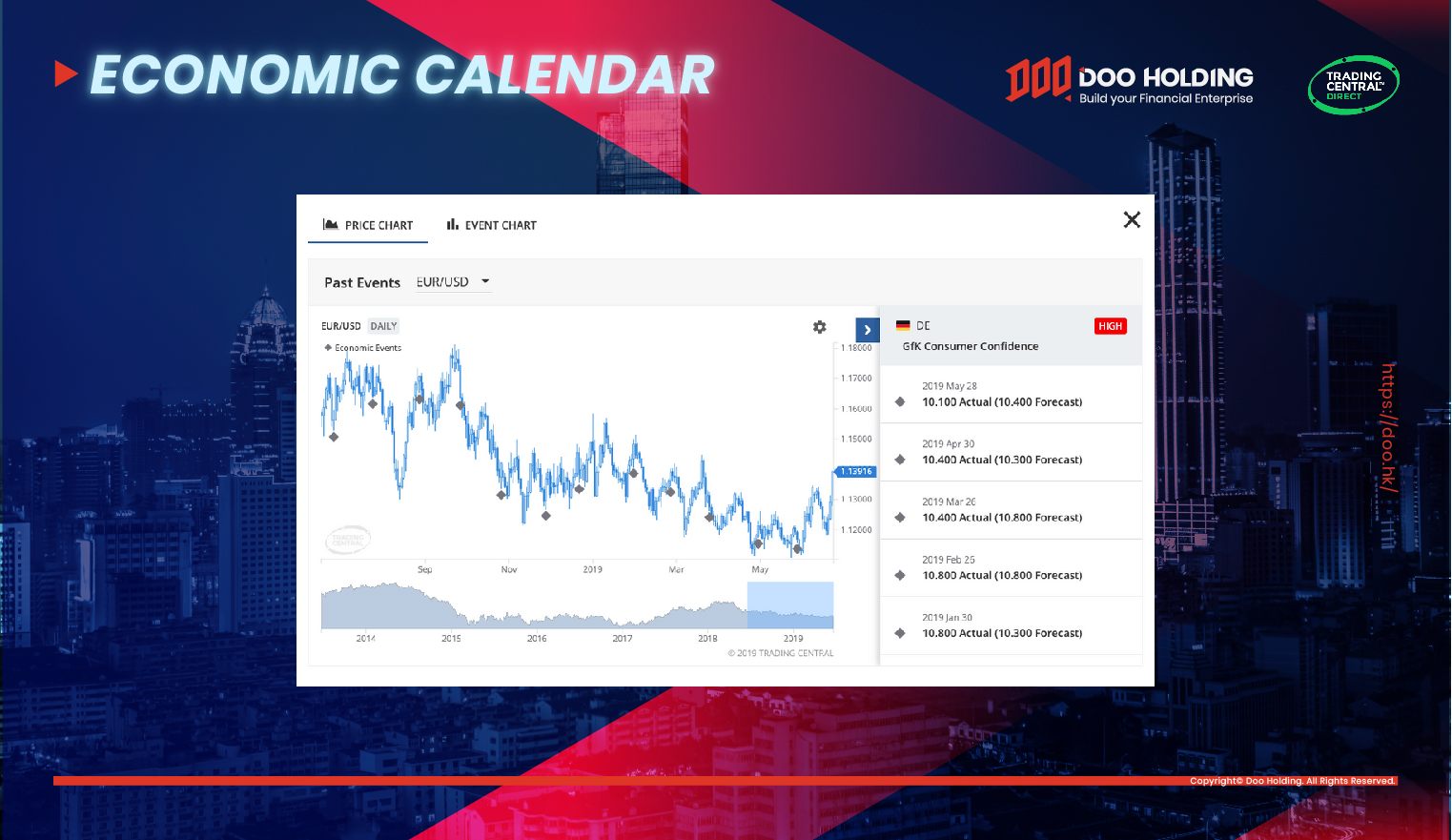

Economic Calendar

Trading Central, Economic Calendar Interface

Trading Central Economic Calendar empowers traders to easily monitor, anticipate, and act on potentially market-moving movements with real-time, actionable macro-economic data.

Partnering with Trading Central allows Doo Prime’s investors to filter the economic events of 38 countries by its importance, track each event in real-time, or take a peek at how similar events previously played out on the FX chart instead of just getting static charts or impact previews.

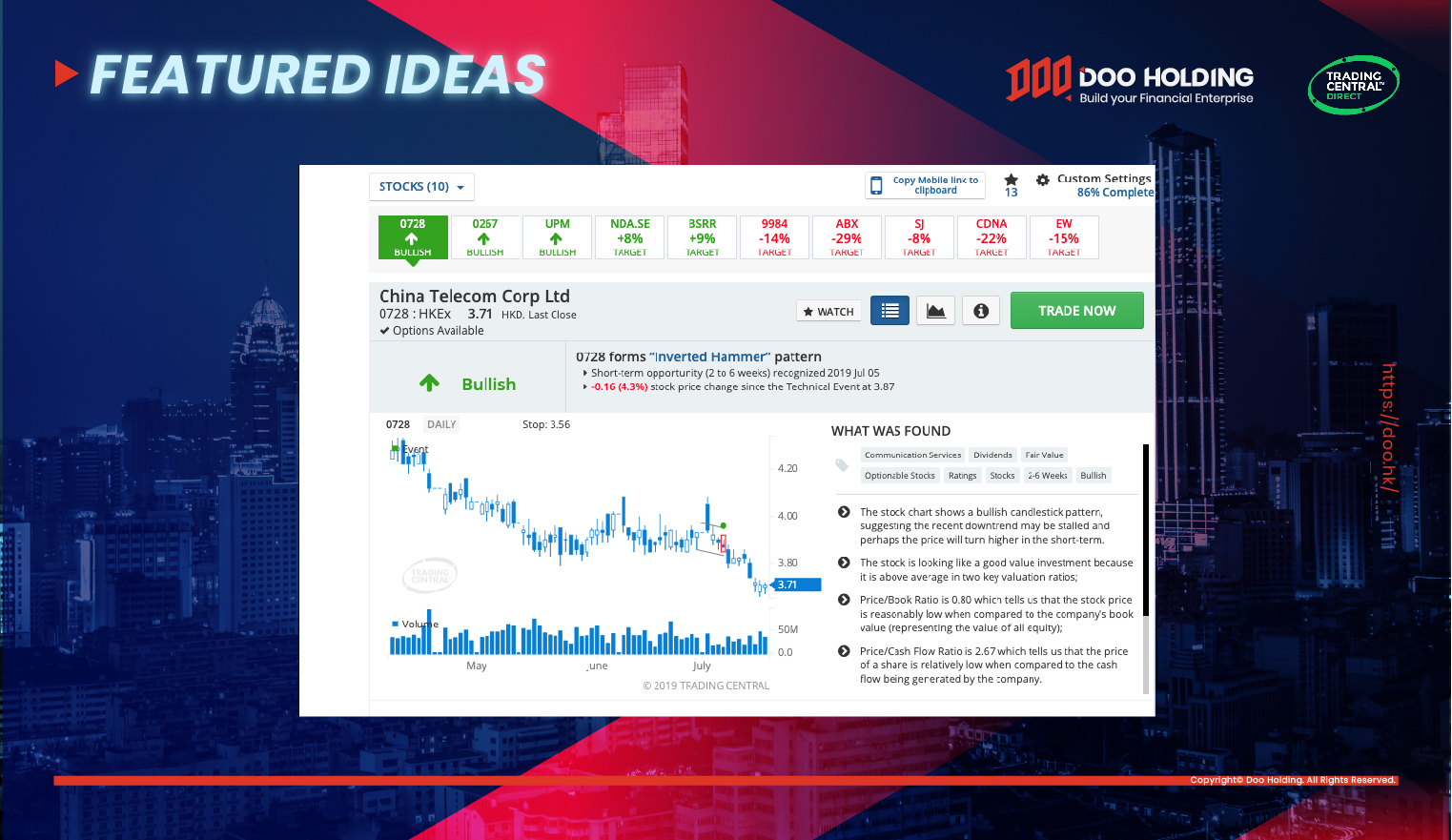

Featured Ideas

Trading Central, Featured Ideas Interface

The Forex Featured Idea helps in supporting and engaging Doo Prime’s customers by delivering live bullish or bearish investment ideas based on technical and fundamental analysis which is supported by backtested strategies.

Together with Trading Central, Doo Prime will be able to deliver the best service to our customers.

— Ends —

For further information, please contact us via:

Tel:

Europe: +44 1137335199

Asia: +852 3704 4241

Asia – China: +86 4008427539

Email: support@dooprime.com

Website: https://www.dooprime.com