Today’s News

U.S. stocks surged to record highs on Wednesday after Donald Trump’s victory in the 2024 presidential election, marking a remarkable return to the White House for the Republican candidate.

With investor optimism fueled by expectations of tax cuts, deregulation, and Trump’s active approach to the economy, the Dow, S&P 500, and Nasdaq all closed at all-time highs. However, some market analysts warned that new tariffs under Trump’s administration could bring challenges, potentially driving up the deficit and inflation.

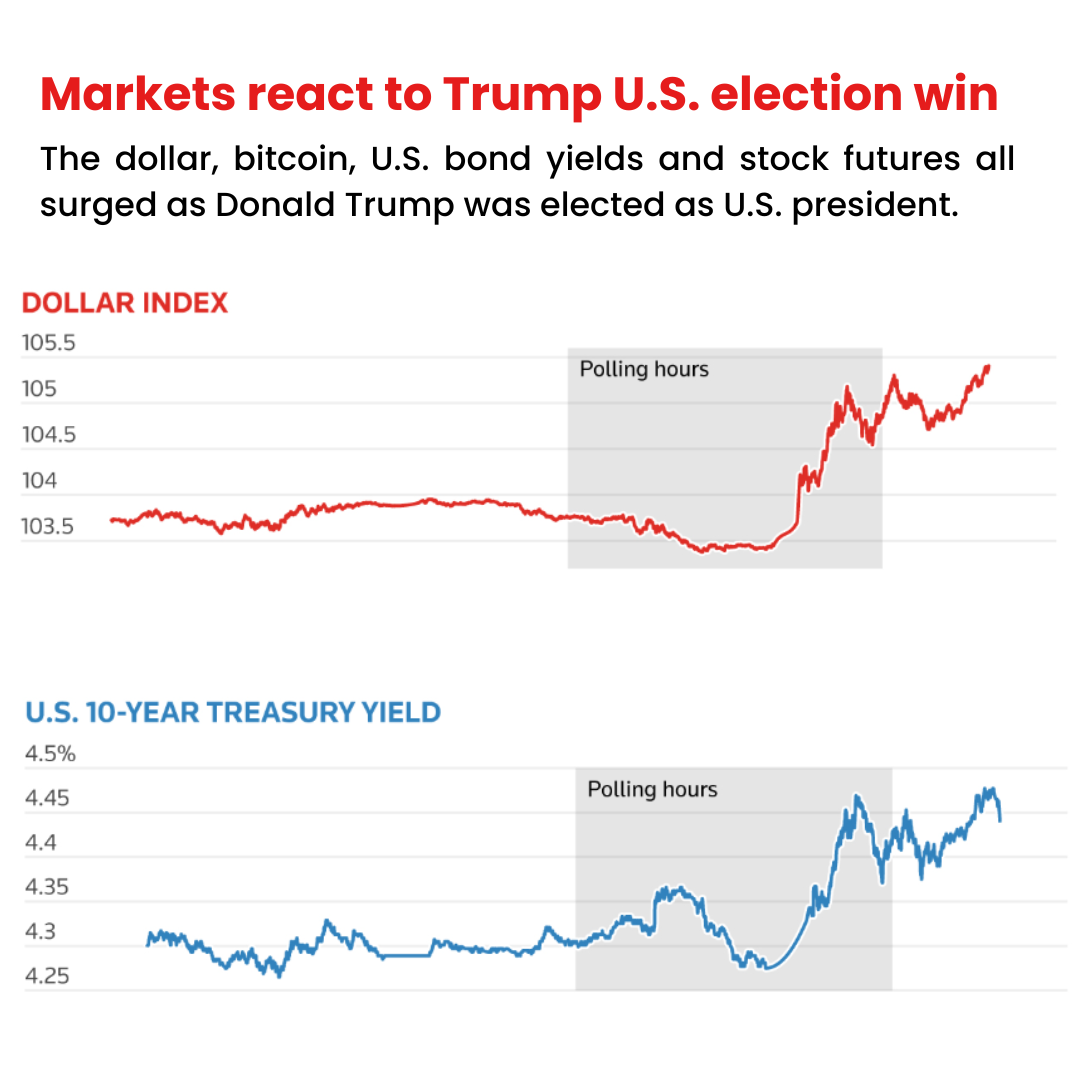

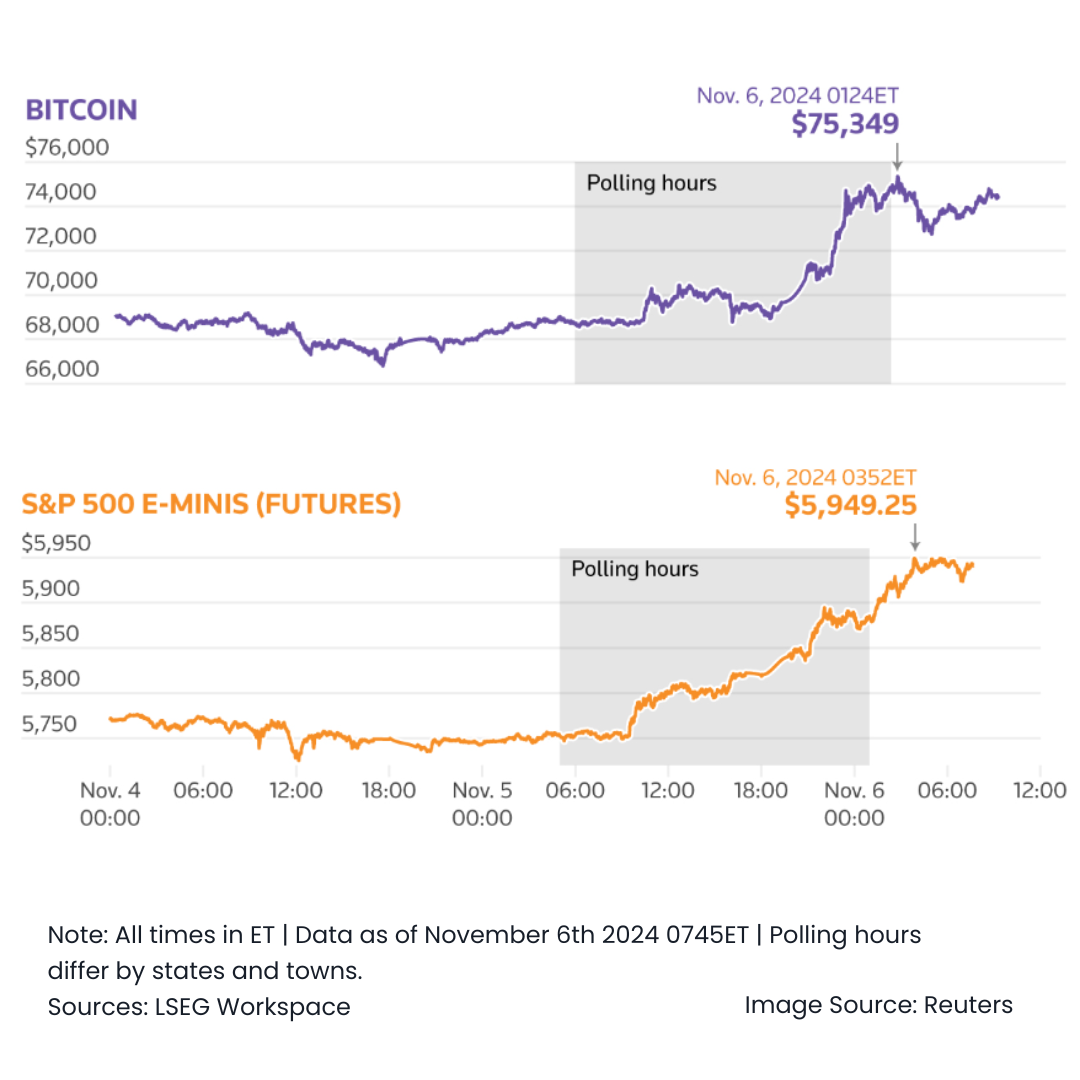

The election result sparked a surge in “Trump trades,” pushing U.S. Treasury yields higher, with the 10-year note reaching a four-month high at 4.479%. Bitcoin also hit a record above USD 76,000, while the dollar notched its largest single-day gain since September 2022.

“Investors were portfolio jockeying to adjust their risk exposure ahead of what was shaping up as a close election,” said Mark Luschini, chief investment strategist at Janney Montgomery Scott. “Once the outcome became clear, we saw a sharp shift to risk-on sentiment.”

The Dow rose 1,508.05 points, or 3.57%, to 43,729.93, while the S&P 500 gained 2.53% to end at 5,929.04, and the Nasdaq advanced 2.95% to 18,983.47. The S&P 500 and Dow recorded their largest one-day percentage gains since November 2022, while the Nasdaq marked its best day since February.

Financial stocks led gains, with the S&P 500 financial sector up 6.16%, driven by expectations that Trump’s policies would favor banks. The S&P 500 bank index rose 10.68%, marking its strongest performance in two years.

Small-cap stocks in the Russell 2000 surged 5.84%, benefiting from the anticipated regulatory easing and lower taxes under a Trump administration. However, rising Treasury yields could challenge smaller companies that depend on borrowing, especially if yields climb above 4.5%.

The CBOE Volatility Index (VIX), Wall Street’s “Fear Gauge,” dropped sharply to a six-week low, signaling reduced investor anxiety. In contrast, sectors sensitive to interest rates, like real estate and utilities, saw declines as traders assessed the inflationary potential of Trump’s policies and their impact on the Federal Reserve’s interest rate trajectory. The central bank is expected to reduce rates by 25 basis points this week, but some investors are beginning to reconsider future cuts.

Stocks closely aligned with Trump’s agenda, such as Trump Media & Technology Group, rose nearly 6%, while Tesla shares surged 14.75% with Elon Musk’s public support for Trump’s campaign. Gains were also notable among cryptocurrency firms, energy companies, and private prison operators, while renewable energy stocks lagged.

Markets also watched for the final results in congressional races, with the Republican Party potentially holding a majority in the House and having gained control of the Senate. A strong Republican presence in Congress could further smooth the path for Trump’s policy agenda.

Trading volumes were high, with 18.68 billion shares exchanging hands, well above the 20-day average of 12.16 billion. The market recorded a positive breadth, with more stocks advancing than declining on both the NYSE and Nasdaq.

Other News

Musk’s Influence with Trump Could Benefit His Companies

Elon Musk’s support for Trump’s re-election could grant him substantial sway in shaping favorable policies for his businesses. With Trump’s potential appointment of Musk as “efficiency czar”.

Qualcomm’s Forecast Boosted by Chinese Smartphone Demand

Qualcomm expects stronger-than-forecast sales, supported by new smartphone launches from Xiaomi, Oppo, and Vivo. Shares jumped 5.5% following a USD 15 billion buyback announcement.

ECB Warns New Tariffs Risk Triggering Vicious Trade War Cycle

The European Central Bank’s Vice President Luis de Guindos warned that new tariffs promised by President Trump could harm global growth and spark a retaliatory trade war.