The big question in financial markets right now is clear: Is a recession in 2025 coming? To answer that, investors should consider watching the US dollar closely.

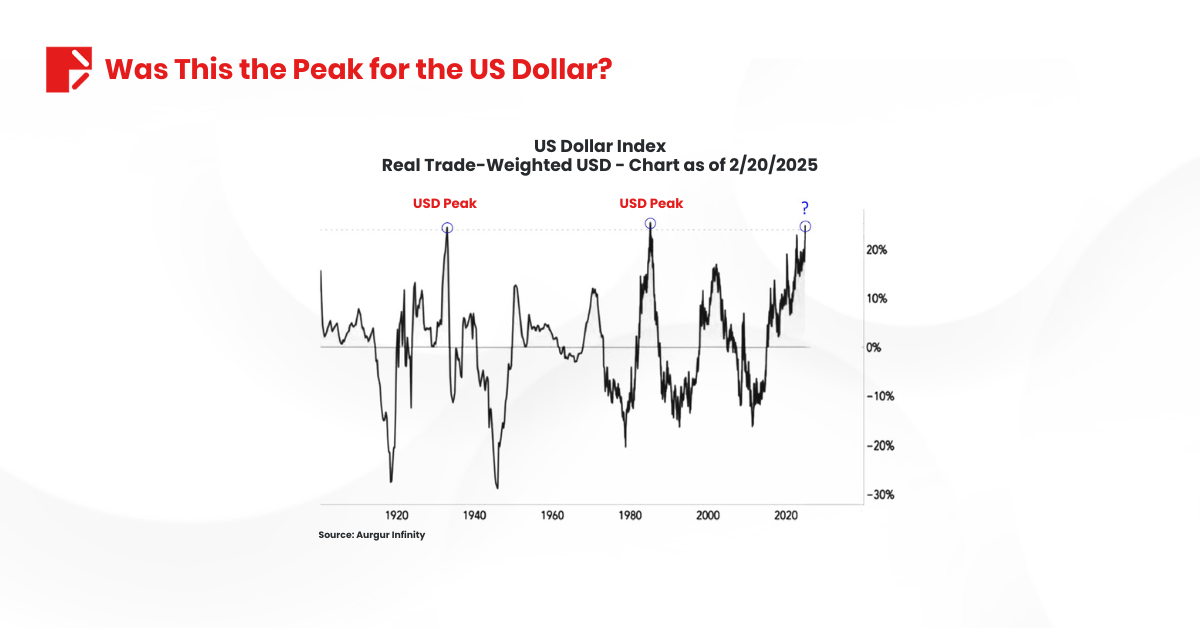

While markets shout, “recession 2025,” the US dollar isn’t behaving like it’s expecting one. Instead of acting as a traditional safe haven, the dollar is weakening significantly.

The US Dollar Index just hit its lowest level since November 2024. Rate-cut bets are piling up. And now, even Fed officials are worried about the dollar’s future. “I am worried more and more about factors that could threaten dollar reserve status,” says Fed’s Harker.

So, what’s behind the falling USD? And what does it mean for traders and investors?

Trump’s Policies and Recession 2025

Love him or hate him, Trump’s policies move markets. Currently, these policies are contributing to a weaker USD.

First, fiscal policy. Unlike his first term, Trump 2.0 is focused on reducing government spending and deficits. While this could be positive for long-term debt sustainability, it also raises concerns about economic growth slowing down. Investors are reacting by shifting away from the USD, anticipating potential monetary policy adjustments to counteract the slowdown.

Second, rate cuts. Bets for more active U.S. rate cuts are hitting the dollar. Markets are pricing in aggressive easing from the Fed. When rates fall, the yield advantage of the USD shrinks, making it less attractive compared to other currencies.

Third, trade tensions. Trump’s “America First” rhetoric is back, and global markets are bracing for new tariffs and potential trade wars. This adds another layer of uncertainty, pushing investors toward other assets.

Why the USD is Falling and What It Means

Historically, when a recession approaches, investors, particularly the “smart money” rush into the safety of the US dollar. Not this time. Instead, the opposite is happening.

This tells us one thing: the odds of an imminent recession could be low.

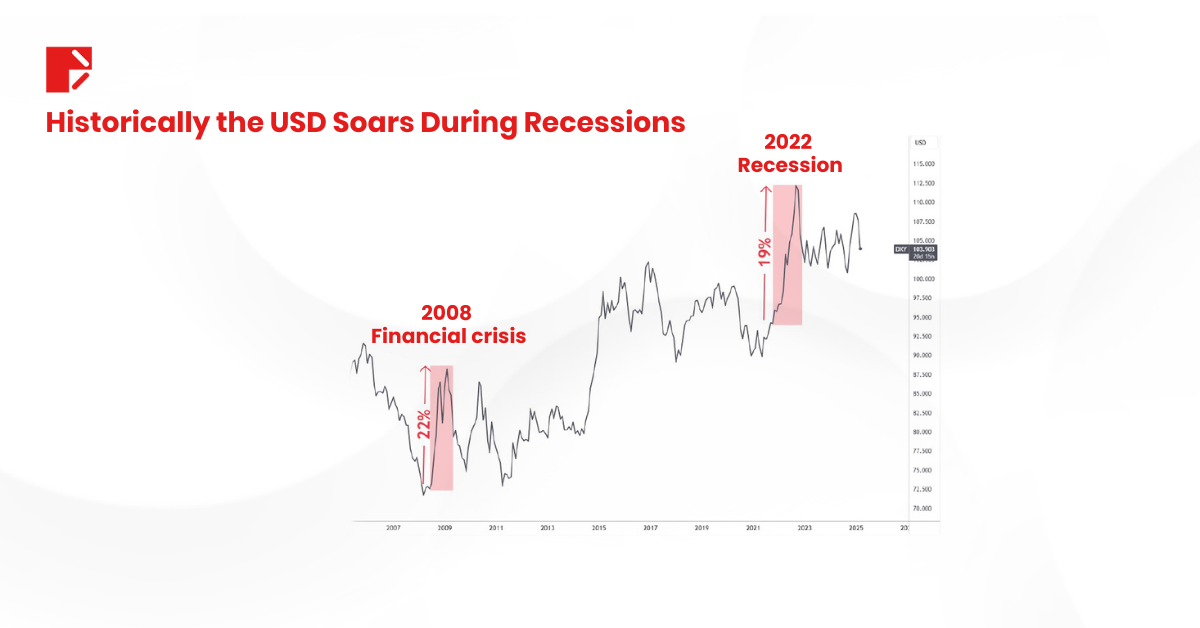

In the 2008 financial crisis, the US Dollar Index (DXY) soared over 20%. During the 2020 COVID recession, the dollar gained around 7%, and in the 2022 recession, the dollar strengthened roughly 20%. Traditionally, a strong dollar signals heightened recession fears.

But recession 2025 is different. Right now, the weakening dollar is a critical indicator: markets are fearful, but smart money doesn’t truly believe in imminent economic collapse.

So, it’s crucial to keep an eye on the strength of the dollar to see beyond the fear in the markets.

Opportunities from the Weak Dollar

The market is pricing in slower growth but not an economic collapse. Historically, traders see opportunities in assets that benefit from a weaker dollar:

- Stocks: US equities tend to outperform when the dollar weakens, making American companies globally more competitive.

- Gold: Traditionally inversely correlated to the dollar, gold could rally further if rate cuts deepen dollar weakness.

- Crypto: Bitcoin and other cryptocurrencies could benefit significantly as liquidity expands and inflation fears subside, particularly when the dollar depreciates.

The Contrarian Trade of Recession 2025

Smart money saw this coming.

When everyone was screaming “recession 2025,” those who saw past the panic started shorting the dollar. So far, this strategy has paid off handsomely, as DXY is down more than 4% year-to-date.

The Global Ripple Effect

A weaker USD doesn’t just affect American markets, it has global consequences.

Emerging markets, for instance, often benefit from a weaker dollar because their debt, often denominated in USD, becomes easier to manage.

Meanwhile, European and Asian currencies are gaining strength. The euro, yen, and yuan are all seeing inflows as investors seek alternative safe-haven assets. This could put additional pressure on US exports, making them less competitive overseas.

What’s Next for the Fed?

All eyes are on Powell and the Fed. If they follow through with aggressive rate cuts, the dollar could weaken further, fueling more potential upside in risk assets. But if inflation remains persistent, the Fed may have to slow down, potentially stabilizing the USD but causing market volatility.

It’s a delicate balancing act. Cut too fast, and inflation might come roaring back. Cut too slow, and markets could panic, triggering a sell-off in risk assets.

Investors should consider:

- Monitoring stocks as the dollar fluctuates.

- Evaluating gold as a potential hedge if dollar weakness continues.

- Keeping an eye on cryptocurrencies as liquidity conditions evolve.

Final Thoughts on Recession 2025 and the Dollar

Whether recession 2025 materializes or not, the dollar remains a critical indicator. Currently, the weakening dollar raises important questions about future economic stability.

For investors, this shift presents potential opportunities. A weaker USD historically benefits equities, gold, and crypto assets.

The only question now: How far will the Fed go? And will traders continue to bet against the almighty dollar?

Risk Disclosure

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above information should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.